Optimize working capital, increase your team’s efficiency, and reduce business risk. Discover how OneSource Virtual’s solutions can help.

Frequently Asked Questions

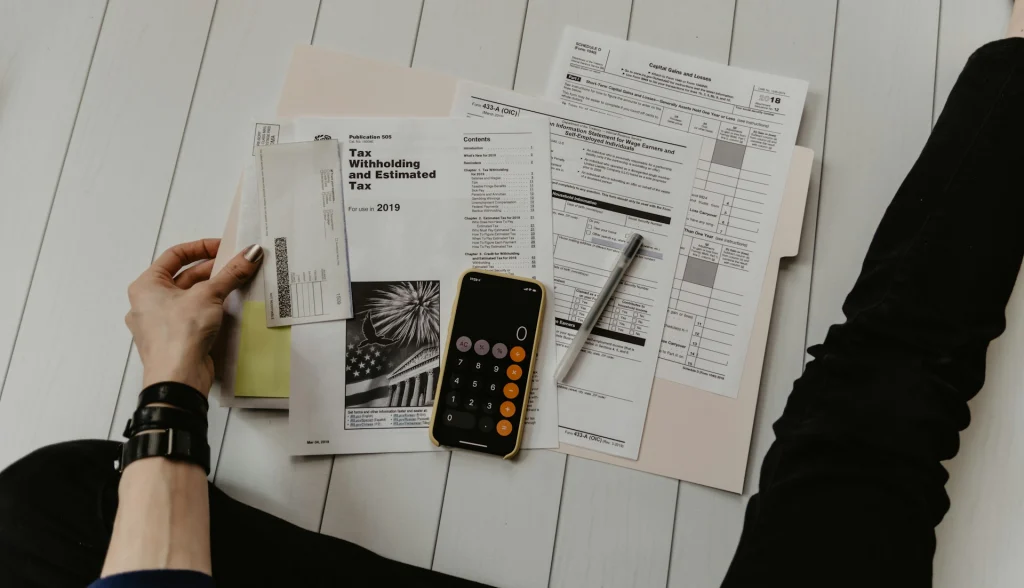

Tax Services

When should I file my business taxes?

Filing deadlines depend on your business structure. Sole proprietors typically file by April 15, while partnerships and S corporations usually file by March 15. C corporations generally file by April 15 as well. Extensions may be available, but taxes owed are still due by the original deadline.

What business expenses are tax-deductible?

Most ordinary and necessary expenses related to running your business are deductible. This can include office supplies, rent, utilities, advertising, software, professional fees, travel, and a portion of home office expenses if applicable.

How can I reduce my tax liability?

You can reduce your tax liability by tracking expenses accurately, taking advantage of deductions and credits, making estimated tax payments, contributing to retirement plans, and using tax planning strategies tailored to your business.

What if I can't pay my tax bill?

If you can’t pay in full, options may include payment plans, penalty relief, or negotiating with tax authorities. It’s important to address the issue early to avoid additional penalties and interest.

Bookkeeping

How often should I update my books?

Ideally, bookkeeping should be updated monthly. Regular updates help you stay on top of cash flow, avoid errors, and make informed business decisions.

What records do I need to keep?

You should keep receipts, invoices, bank and credit card statements, payroll records, tax filings, and any documentation related to income and expenses. Most records should be retained for at least 3–7 years.

Should I use cash or accrual accounting?

Cash accounting records income and expenses when money changes hands, while accrual accounting records them when they are earned or incurred. Small businesses often use cash accounting, but accrual may be required or more beneficial as your business grows.

How do I choose accounting software?

Choose software based on your business size, budget, and needs. Popular options offer features like invoicing, expense tracking, bank integration, and reporting. Ease of use and scalability are also important factors.

General

How much do accounting services cost?

Costs vary based on the scope of services, business size, and complexity. Some services are billed hourly, while others are offered at a flat monthly or annual rate.

What documents do I need for tax preparation?

Common documents include income statements, expense records, prior-year tax returns, payroll reports, bank statements, and any tax forms you received (such as 1099s or W-2s).

Do you work with clients remotely?

Yes, many accounting services are provided remotely using secure online tools, making it easy to work with clients regardless of location.

What's the difference between a CPA and a bookkeeper?

A bookkeeper records and organizes daily financial transactions. A CPA (Certified Public Accountant) is licensed to provide higher-level services such as tax planning, financial analysis, audits, and representation before tax authorities.

How PrimeBalance can help

Comprehensive services

Solutions for the complete AP process plus the ability to accommodate all invoice types (including ad hoc and miscellaneous payments) with one consistent process.

Decreased IT strain

No need to purchase any additional software or maintain integrations.

Single system of record

We leverage your Workforce application for security, supplier data, rules, and workflows.

Scalability for growth

With our team working as an extension of yours, you can outsource as much or as little as you like and accommodate fluctuations in both invoice volume and staffing.

“Getting early access to money you’ve already earned seems so simple, but this is a real revolution in pay that is already making it easier to recruit and retain staff.”